Phishing scam adds a 'chatbot-like' twist to steal credit card information and more

A newly discovered phishing campaign tries to ease potential victims into feeling secure about sharing credit card numbers and other information, according to research published Thursday by Trustwave's SpiderLabs team.

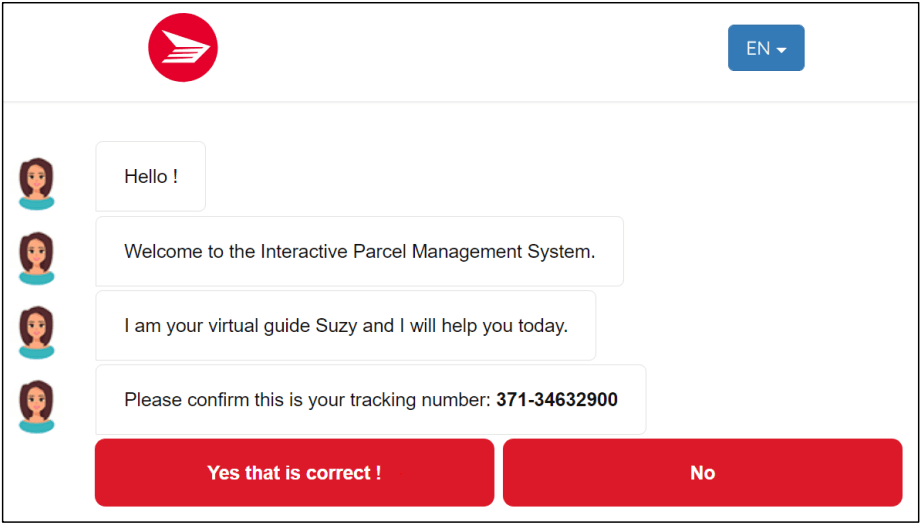

The process includes a "chatbot-like" page that "tries to engage and establish trust with the victim" rather than simply embed an information-stealing link directly in an email or attached document, according to the report.

"We say 'chatbot-like' because it is not an actual chatbot," writes researcher Adrian Perez. "The application already has predefined responses based on the limited options given."

Responses to the bogus bot take the potential victim through a series of steps that include a fake CAPTCHA, a login page for a delivery service and ultimately a page that captures credit card information.

Like the fake chatbot, some of the other steps in the process aren't very sophisticated. The CAPTCHA, for instance, is just a jpeg file, according to SpiderLabs. But the credit card page actually executes a few things in the background.

"The credit card page has some input validation methods. One is card number validation, wherein it tries to not only check the validity of the card number but also determine the type of card the victim has inputed," Perez writes.

The company says it discovered the campaign in late March, and as of Thursday morning it was still active.

The SpiderLabs report is just the latest warning about the creativity of cybercriminals who focus on credit card information. Researchers at Trend Micro warned in April that cybercriminals were using fake "security alerts" from popular banks as part of phishing schemes. Discussions about using phishing attacks to harvest credit card information increased on dark web forums last year, Gemini Advisory said in its annual report for 2021.

Another method — skimming the card data directly from shopping websites — remains popular.

Researchers at RiskIQ said this week that they have seen a "consistent increase" in skimming activity lately, and not all of it is connected to known groups that use the notorious Magecart malware.

The FBI also issued an alert this week about a specific case of skimming identified in January 2022. The bureau had no comment to questions from The Record about where it got the tip.

Joe Warminsky

is the news editor for Recorded Future News. He has three decades of experience as an editor and writer in the Washington, D.C., area. He previously he helped lead CyberScoop for more than five years. Prior to that, he was a digital editor at WAMU 88.5, the NPR affiliate in Washington, and he spent more than a decade editing coverage of Congress for CQ Roll Call.