Feds nab alleged money launderers for pig butchering scheme

Two alleged ringleaders behind a scheme that laundered some $73 million stolen in pig butchering scams are in U.S. custody, the Department of Justice announced Friday.

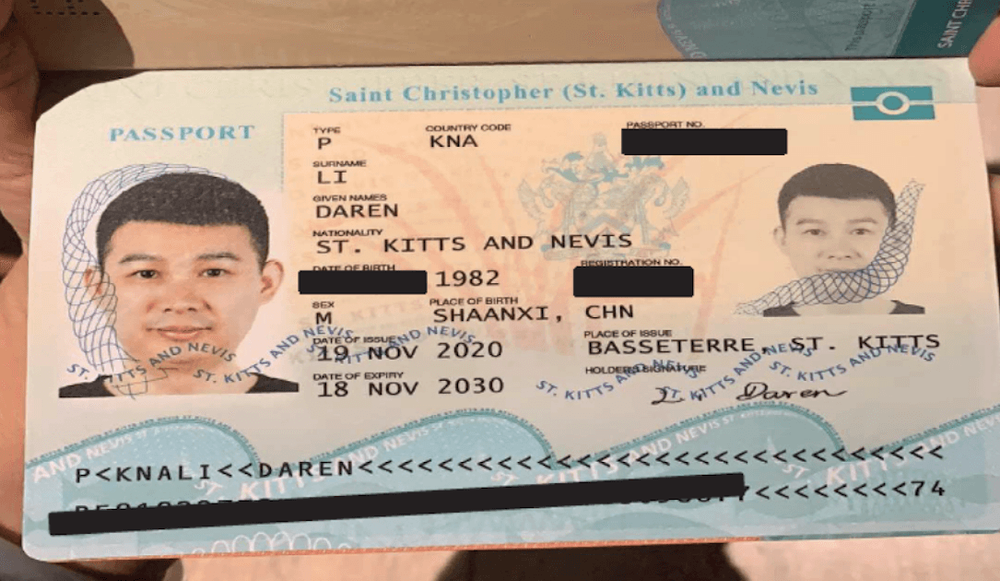

Yicheng Zhang, a Chinese national who lives in California’s Temple City, was arrested Thursday in Los Angeles, and Daren Li — a citizen of China and St. Kitts and Nevis — was apprehended at Atlanta’s Hartsfield-Jackson International Airport on April 12. Li lives in China, the United Arab Emirates and Cambodia, the DOJ said.

According to court documents unsealed Friday, Zhang and Li directed an intricate money laundering web in which a team of subordinates opened up approximately 74 shell companies and associated bank accounts. Pig butchering typically involves a scammer forming a relationship with a victim on messaging platforms before persuading them to make fraudulent investments.

Money stolen from victims was deposited into those accounts before being transferred to two bank accounts at Deltec bank in the Bahamas, the DOJ said. One of the Bahaman accounts was registered by a company called GTAL (Cambodia) Co., Ltd., which is based in the coastal city of Sihanoukville — a notorious pig butchering hub rife with scam compounds.

Eventually, the funds were converted to USDT — a cryptocurrency tied to the value of the U.S. dollar — including to a Binance wallet purportedly connected with Li. A separate wallet allegedly connected to the scheme received about $341 million in virtual currency over three years beginning in April 2021.

The arrests are part of an investigation that began in September 2022 into a “criminal money-laundering syndicate” operating investment scams. In December 2023, that investigation resulted in charges against four people accused of laundering criminal proceeds and the arrest of two of the men.

A search of their phones allegedly revealed communication with Li, who was shown to have “a leadership role in determining where victim funds should be sent and in the management of the bank accounts receiving victim funds.”

According to the complaint against Li, a victim of the scheme in New Jersey approached investigators about an investment scam beginning in May 2022 saying he had been contacted on WhatsApp by a person going by “Angela,” who eventually convinced him to make cryptocurrency investments on a spoofed platform imitating the legitimate exchange CoinZoom. In two months, he invested about $1.5 million, but when he tried to cash out he was informed he needed to pay a fee and taxes.

“Victim 1’s experience with the fraud is generally consistent with those of hundreds of other victims who have reported their losses to law enforcement,” a U.S. Secret Service agent wrote in the complaint.

Investigators tracked a portion of the funds to a bank account connected to CMD Export and Import, allegedly one of the 74 shell companies created as part of Li and Zhang’s scheme.

The men are both charged with conspiracy to commit money laundering and six counts of international money laundering and face a maximum penalty of 20 years in prison. Zhang has pleaded not guilty to the charges, while Li has yet to be arraigned.

Last year, reported American losses due to crypto-linked investment fraud jumped to $3.96 billion, according to the FBI’s Internet Crime Complaint Center.

“Complex financial fraud schemes such as pig butchering present a clear and present threat to the financial infrastructure of the United States as countless numbers of Americans continue to be victimized by this predatory activity,” Assistant Director of Investigations Brian Lambert of the Secret Service said in a DOJ release.

James Reddick

has worked as a journalist around the world, including in Lebanon and in Cambodia, where he was Deputy Managing Editor of The Phnom Penh Post. He is also a radio and podcast producer for outlets like Snap Judgment.